Mueller Home in the Affordable Program

Update: It’s 2020 and there are still new and resale affordable homes at Mueller, though the resale homes aren’t always highly publicised. (this 3 bedroom detached home is a rare exception)

If you earn too much for the affordable program then all is not lost as Mueller Affordable Resale homes allow you to earn 1.5 times as much and still qualify.

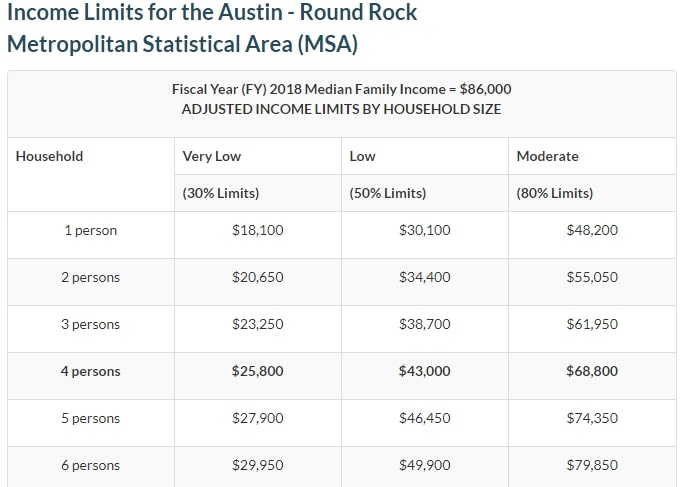

The upper income limit for new affordable homes is 80% of the Austin Median Family Income (MFI). That’s a set of numbers published by the department of Housing and Urban Development, which varies by household size.

The good news if you don’t fit that 80% MFI income, the resale homes can be bought with an income of 120% MFI.

The 2018 numbers are here

Here are the questions we most frequently get asked about the homes and the program.

Can I rent out part of my Mueller affordable resale home?

Yes – you can rent out a room as long as you live there as your primary home. You can’t rent out the whole thing – that’s against the idea of the program.

Can I have bad credit and buy an affordable home?

You’ll need good credit to buy, as you’ll still be buying with a mortgage. There are a few lenders who really understand the process and the lending requirements, and in our opinion it’s worth working with a lender who has done this many times before. In general, you need to have good credit and low debt to qualify for the program.

How do I find out about affordable resale homes?

There’s a list maintained by the group that administers the affordable program. Since they have to be contacted when someone sells (they have first right of refusal to help another buyer purchase the home, and the first part of that is getting a current market valuation of the home), they know all the current homes coming up for sale. Or you could ask us – we represent people who buy these homes – at no cost of course.

What type of houses come up on the Mueller affordable resale market?

As of this year, we’ve had detached homes, row homes and condos appear in the resale program. Homes with 2-3 bedrooms, under 1450 sqft, all throughout the development.

What kind of down payment do I need for a Mueller affordable resale home?

It varies depending on the loan that you qualify – get in touch if you want us to connect you with a mortgage broker to discuss.

Can I buy an Mueller affordable resale home if I’m retired?

The rules state that you have to be working a minimum number of hours per month to participate in the program.

Can I buy a Mueller affordable resale home in cash or do I need a mortgage?

Mortgage. If you had say $220,000 to purchase a home, you would fail the asset test.

Do I need a Realtor to buy one?

As you’ve probably guessed, we think it’s a good idea. We’ve helped people buy affordable and affordable resale homes before, and there are some intricacies to the process which can make a big difference to your financial outcome – it depends how you negotiate them. And it doesn’t cost you anything to use someone with experience so if you’re interested in learning more, get in touch.

Get in Touch

Call us on +1 (512) 829-1351 and we’ll answer any questions you might have.

listing image courtesy Realty TX