Negotiating a home sale is a mixture of balancing risk, terms and contingencies.

The biggest mistake I see is agent misinterpretation of the form used for adding a financing contingency to the purchase contract. Screwing it up can mean the transaction is left high and dry for an indefinite period of time. That could be quite costly and lead to frustration.

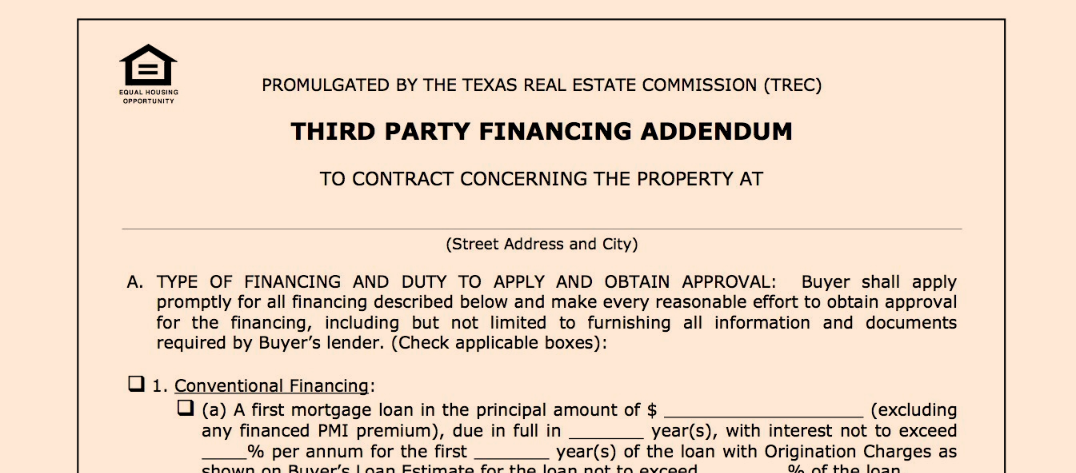

What we’re talking about is this beautiful little form: The Third Party Financing Addendum For Credit Approval

As a seller, you want to minimize contingencies – get out clauses for the buyer, so that you can be more sure your home will actually sell. And that it will sell in a specific time.

As a buyer you want as many escape clauses as possible.

There are several major and common reasons a transaction for a home purchased with a loan will not close:

1. The lender’s appraiser values the home lower than the contract price – and won’t lend any money. There are obviously ways around this, beyond the scope of what we’re talking about here – get in touch if you want to know more.

2. The buyer doesn’t qualify for the financing – they don’t get credit approval. The lender would possibly lend on the home, but not to the buyer. That’s why it’s vital to obtain a pre-approval letter (different from a pre-qualification letter by a whole bunch) as a buyer, and for the seller’s agent to verify that the lender letter is legitimate. (As a client of mine said recently, anyone can get their brother-in-law to write a lender letter)

So the Third Party Financing Addendum only talks about the second item – buyer credit approval. It gives the buyer a time line in which to fully apply for the loan with the terms laid out in the added. This is the buyer’s credit approval, nothing to do with the home.

I repeat, this has nothing to do with the appraisal value of the home

Many agents believe that this contingency period has to include a number of days for the entire loan to be underwritten (including the home, title work, and buyer’s credit). It doesn’t. This portion just covers the buyer, and can be turned around by a competent lender in under one business week.

So as a seller, don’t accept an unwieldy amount of time in the 3rd party financing addendum – time is of the essence, and it shouldn’t take 28 days to get a buyer approved and underwritten. That’s the number of days I see many agents putting in by default.

So what about the appraisal – that’s a big contingency that can scupper a sale – when does that happen?

Unless the contract specifies a date for the appraisal, then the buyer can back out of the contract due to a low appraisal at any time before closing. That’s right, the purchase contract (not the addendum) specifies that the contract is contingent on appraisal (and title etc) throughout.

So as a seller, to ensure a timely appraisal for a far off close date, you might add some additional language to the contract to demand an appraisal quickly. Otherwise you could be in contingency limbo for a long time.

Kathy Sokolic helps clients buy homes at Mueller Austin and beyond.