I love the Mueller Affordable Program, I’ll just put that out there as my bias before I start talking about tax appraisals. It’s that time of year when Travis County Appraisal District give everyone the bad news that property taxes are going up. The real estate market in Austin is booming and many homes are worth much more than they were last year, so it’s reasonable for TCAD to levy more tax per the Texas Property Code.

How does this impact the Mueller Affordable home owner?

Well, one piece of good news is that TCAD, when it knows about the program, only uses the affordable portion of the home for it’s tax appraisal.

To illustrate this, I invented a fictitious home for a few charts below.

- Market value: $220,000

- Affordable price: $132,000

In rough terms, the buyer will own 60% of this home, so TCAD only calculates appraised value based on the affordable price, or $132,000. They wrote a letter in 2009 to that effect. With a tax rate of 2.3%, not allowing for exemptions, this amounts to a monthly property tax bill of $253.

Now, in my little model, the value of homes increases linearly at 3.5% per year. This is completely artificial, and real estate markets are certainly not linear. So the market value continues to climb.

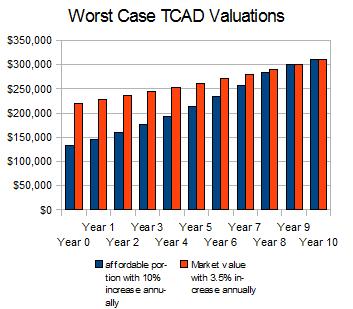

In the first scenario, after year zero, TCAD starts to raise the value upon which the taxes are collected – the assessed value by the maximum they are allowed for a homestead, i.e. 10%. To repeat, there is a cap of a 10% increase in property tax bills for homestead property in Travis County(unless you remodel or sell the home). By Year 9, the value that TCAD are collecting taxes upon is already the market value, and now the monthly tax bill is $575. That’s an increase of $322 in bills per month.

TCAD raise at 10% annually

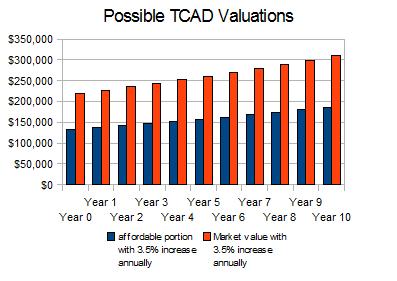

In the second scenario, after year zero, TCAD takes a more leisurely increase in assessed value at just 3.5% – the same fictitious constant we used for market value appreciation. By year 9 in this model, the monthly tax bill is now $345 – an increase of $92 per month over the first year.

TCAD raises your taxes at 3.5% annually

So why does this matter? The income restrictions on the affordable buyer are pretty tight – you have to earn enough but not too much. And if you’re adding to the annual property tax bill year on year, sooner or later, some people are going to be forced to sell.

Now the good news in all of this is that my model ignores inflation, so those who are in employment will hopefully benefit from some wage increases during the period, and hopefully salary rises will offset the increase in property tax.

The bad news is that the affordable home buyer who just managed to qualify now, and sees rises in property taxes in the next several years may not be able to foot the increased bills.

So what to do?

- If you bought a home in the affordable new or resale program, ensure that you file your homestead exemption. This caps the rise in appraised value at 10% each year.

- If you bought an affordable resale home, be prepared to protest your taxes. It seems that TCAD don’t necessarily know the affordable price you paid, and will tax you on the market value.

It seems that there are many nervous people faced with a 10% rise in their property taxes this year – if you have any questions, please get in touch.