With so many people relocating to Mueller from other states these days, I thought it prudent to answer this frequently asked question – what are Mueller property taxes?

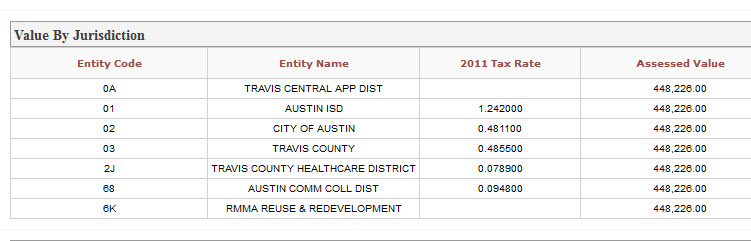

What is the property tax rate? Well, it varies. For 2011 it amounted to be around 2.31%. I pulled the public tax record for one of the model homes which shows the taxing rates and the assessed value of that home. See below. The Travis County Appraisal District (TCAD) is responsible for assessing home values and collecting property tax.

Why are the property tax values on the different home sales websites so different? There are a number of reasons why the sites that pull data from the Multiple Listing System might show a wildly inaccurate number:

- The home may have been recently completed, and the appraised value for TCAD is as of the 1st January of the current year. So a home that wasn’t built at the start of the year would have an appraised value of roughly $30,000 to $125,000 – the value of the land alone. The property tax bill will be over 6 times higher next year when the value of the structure is taken into account.

- The existing homeowner may have exemptions – over 65, homestead, disability – all of which impact the actual tax collected. Since most sites pull last year’s property tax bill and put it in the “estimated taxes” slot, this is just a reflection of the current owner’s tax bill from last year, not the tax bill that a purchaser would pay this, or next year.

- Appraised values have been rising – often at 10% per year – so that the estimated tax is out of date – based on last years bill

- Appraised values are sometimes just plain wrong – TCAD sometimes makes mistakes e.g. getting the size of a home wrong (and hence the value)

What is a good estimate for my property tax bill if I buy a home at Mueller? The quick and dirty way is to ignore homestead exemptions and figure that you will pay property tax based on the current tax rate multiplied by the sales price of the home. So for a $450,000 home, expect to pay roughly $866 per month.

Why is property tax higher than in my state? Well, I’d love to be able to say it is because Texas has the best funded and finest public school system in the country, but that would not be an accurate representation of my opinion. Texas has no state income tax would be one way of saying it.

How can I research property taxes for a given address if the MLS estimates are so unreliable? Well I could say ask a Realtor who specializes in Mueller, but it’s probably quicker to use these two sites:

Travis County Appraisal District – you can search for a home and see the taxing entities

Travis County Appraisal District – you can see actual tax bills (remember the owner may have different exemptions which affect their bill)

If you have any other questions, please get in touch. 512 215 4785