The Federal Reserve says that interest rate rises are “imminent”, but what impact will this have on house prices, and how can you approach real estate shrewdly if we transition from a period of historically cheap mortgages?

When Will Interest Rates Rise?

If we knew that, we’d be working for the Fed. No-one knows exactly.

On Wednesday the Fed announced that interest rates were going to rise sooner rather than later but said that they were unlikely to rise in April 2015. While we’ve been expecting this for some time, with the current zero or negative inflation it may be that it doesn’t happen much in May either, or even this year.

Still, it pays to know what the likely impact is if you’re considering a real estate transaction in the coming years.

When the Fed Raises Rates Do Mortgage Rates Go Up?

Yes, and no – the mortgage rate is more closely tied to longer term interest rates, and the 10 Year Treasury note in particular. This doesn’t move precisely with the Fed’s rate, and has actually been dropping of late. So in the long term it will, but in the short term we might not expect mortgage rates to go up significantly.

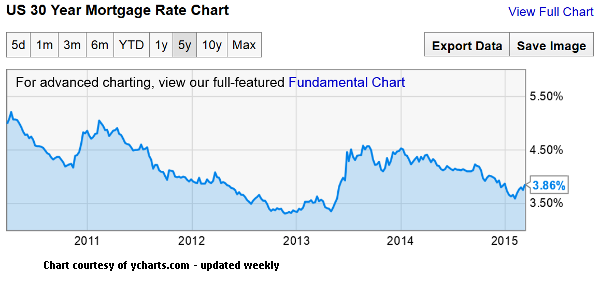

If we look at interest rates we see that they’re still low – anything below 4% means a great time to consider a refinance or lock a rate on a purchase mortgage.

What Happens To House Prices When Interest Rates Rise?

If you read the economics press, there are suggestions that increasing mortgage rates will reduce affordability, reduce demand, and hence lower home prices. That’s certainly one possibility, though the reality might be more complex. The impact of rising inflation or a more productive economy might offset the increase in rates.

What we’re not expecting is a sudden change in mortgage interest rates. For rates like the 18% back in the 1980s to suddenly arrive.

You’ve heard the grizzly story about putting a frog in a saucepan of water on the stove – the water temperature rises so slowly that the frog doesn’t ever feel too hot and fails to jump up before boiling to death.

Hopefully people don’t feel quite as fatalistic about mortgage rate increase, especially since so many people have fixed-rate mortgages which prevent an increase in repayments as the rate fluctuates.

What to Expect in the Austin Housing Market in 2015

It’s very hard to predict how the local Austin housing economy might interact with larger changes in the US and world economies. If rates rise slowly in 2015, I would anticipate the rate of increase of Austin house prices to slow down. I certainly don’t expect them to suddenly tank, or to even drop.

It’s not like we’re coming to the end of the first-time home buyer tax credit season again, when at a certain date if your loan isn’t closed, you don’t get to close and get $8000 in tax credit from the Federal Government. That kind of scheme causes discontinuities in the market, and people paying more for homes than they will be worth in a month’s time.

My guess is that Austin prices will continue to seek a stable maximum. I don’t think we’re going to see prices retreat 10% as in this article, although as investors look to other financial markets as real estate returns go down, that will put negative pressure on property prices. This is summarized neatly at the end of this article about property prices.

What To Do If You’re Thinking Of Buying or Selling a Home

It’s hard to time the market.

If you’re thinking of a personal residence, there’s certainly an advantage to buying and selling now when we know that interest rates are low. March through June are traditionally the first annual hump of peak demand in the Austin home buying season. So go for it!

If you’re looking at investing in property in Austin, mortgage rates are certainly keen – while prices have run up considerably in the last few years, my personal feeling is that they still have space to rise before they calm down. Again, go for it!

Sherlock Homes Austin help buyers and sellers not just in Mueller but all over Austin. Give Garreth or Scott a call on 512.215.4785.